Below, we’ll break down everything you need to know about these bridging solutions in a Q&A style. Whether you’re new to decentralized finance or simply looking to cut your fees, these insights will help you approach cross-chain transfers with confidence.

You’ve probably heard about bridging tokens from one chain to another—like moving your assets from Ethereum to Polygon. A “free” crypto bridge aims to offer that service without charging the usual bridging fee.

However, “free” can be a bit of a misnomer. While the service itself might waive bridging costs, you’ll often still pay for gas. In other words, the platform doesn’t tack on its own additional toll like some paid bridging providers do. But because blockchains require transaction fees, you’ll rarely find a scenario where you spend absolutely nothing.

So, why do these bridges exist? Some decentralized finance (DeFi) projects want to attract new users to their ecosystem. By lowering fees or subsidizing them altogether, they encourage people to experiment with new chains. Others might use you as a test pilot for innovative bridging technologies, letting you transfer tokens at minimal cost while they gather data or build brand awareness.

In short, a free crypto bridge is any bridging tool that drastically reduces or removes bridging fees. You still handle the standard blockchain transaction fees, but not the usual bridging markup. They can be a great option if you’re comfortable scouting for new or lesser-known solutions and want to minimize overhead for your cross-chain transfers.

Most free crypto bridges rely on smart contracts to lock, mint, or burn your tokens. Say you’re moving tokens from Ethereum to BNB Chain. In that case, your tokens on Ethereum get locked in a contract, and an equivalent number of tokens gets minted on the destination chain. When "sending them back," the minted tokens on BNB Chain might be burned, and your original Ethereum tokens get released.

What simplifies or subsidizes these fees? Often, protocols use a few strategies:

Under the hood, the bridging mechanism is almost always a set of smart contracts that confirm you own the tokens on the source chain, then release or mint them on the destination chain. The user experience (UX) can vary widely though. Some free bridges integrate with familiar wallets like MetaMask, letting you do everything on a single interface. Others might require more complex steps or multiple approvals before your cross-chain transfers complete.

One other aspect worth mentioning is time. Cheaper or free gear in the DeFi world can mean a slower process. With fewer bridging fees, the operators might not prioritize lightning-fast confirmations. That’s not always the case, but it can be a trade-off to keep in mind when choosing a free solution over a paid alternative.

Free crypto bridges differ in which networks they support. Most aim to connect popular ecosystems for cross-chain transfers, such as:

Some free bridges are specifically designed for lesser-known or emerging blockchains, hoping to spur adoption on them. Keep in mind that not all blockchains have robust bridging options, especially if they’re relatively new.

When evaluating a free bridging tool, check a few items:

It’s also wise to confirm any bridging times. For instance, bridging from Ethereum to Polygon might take just a few minutes, whereas bridging from Ethereum directly to Avalanche can vary. Each chain has its own consensus mechanism, block confirmation delays, and backlog of transactions.

If you’re in a hurry, look for user feedback or official documentation noting typical speeds. If you can’t find these details upfront, consider bridging a small test amount first to gauge the timing.

Choosing a free crypto bridge for cross-chain transfers can have multiple perks outside the obvious fee savings. Let’s look at why you might prefer this route:

Overall, the main appeal is easy to see: who wouldn’t want to sidestep the typical bridging toll? However, always weigh the trade-offs. A free service can mean a new or experimental tool, and with all things blockchain-related, due diligence is paramount.

Despite being labeled as “free,” these bridges come with their share of risks. The most important ones to remember include:

It’s critical to understand that bridging funds from one chain to another requires trust in the bridging mechanism. If you can’t find any history, reviews, or audits, test with a small amount first. DeFi is about balancing opportunity with caution, and free bridging is no exception.

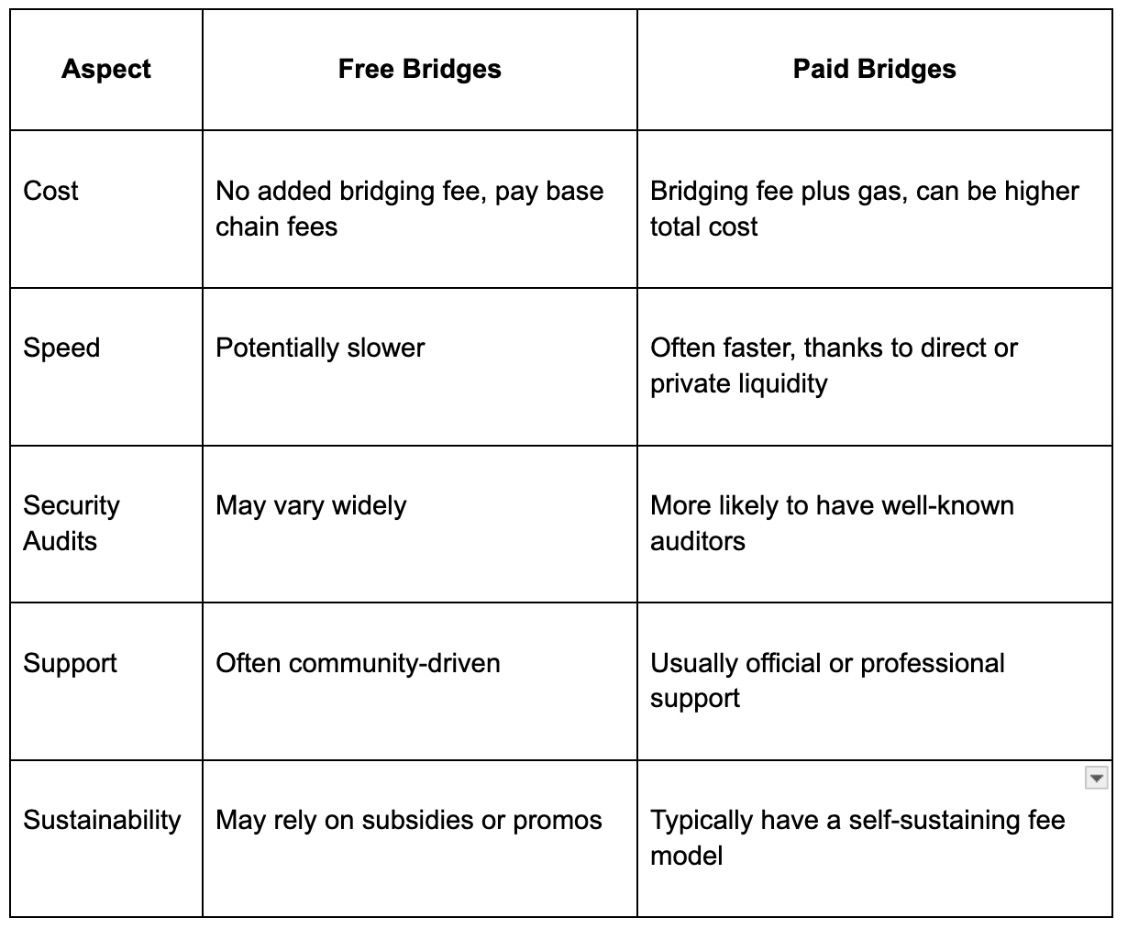

Paid crypto bridges often have more robust infrastructure, better support, and sometimes faster speeds. They might use a portion of their fees to maintain liquidity, ensuring smoother transactions. You might also see well-known names in the bridging space that have proven track records of reliability.

Still, free bridges aren’t inherently low-quality. Some well-regarded projects periodically run free bridging promotions to onboard new users. Others might keep bridging permanently “free” and rely on external revenue streams like yield farming or token issuance.

Paid solutions can provide more peace of mind if they’re partnered with top-tier security audit firms or major DeFi platforms. However, if you’re comfortable navigating newer or smaller ecosystems and want to save money, free solutions can still be a solid option.

If you’re ready to try cross-chain transfers on a free bridge, here’s a general outline. Specific steps may vary depending on the interface, but the core process remains similar.

Remember, bridging is simpler when you have some familiarity with Web3 wallets. If you’re brand new, practice on a test network or with small amounts of stablecoins to reduce risk. You can also look at bridging analytics or tutorials from sites like Dune Analytics to better understand transaction trends and bridging volumes.

Security is no joke in DeFi, especially for cross-chain transfers. Here are some best practices to keep your funds safer:

Finally, do not store large amounts of idle funds in bridging contracts. If you want to hold assets long-term, it’s generally safer on a chain in your own wallet, not in a bridging interface that might be exploited during idle times.

If you’re tired of juggling multiple dApps or looking for a single platform experience, baltex.io might be an option. Instead of directly bridging your assets, baltex.io (an exchange) allows you to swap tokens between chains using their own liquidity. It’s somewhat like bridging built into a trading platform.

Think of it this way: you deposit tokens on one chain into your baltex.io account, then withdraw them on another chain. Because the platform handles the multi-chain liquidity behind the scenes, you’re essentially performing cross-chain transfers without manually bridging. Some folks appreciate this because it feels simpler and they only deal with a single user interface.

Compared to free bridges, baltex.io will likely have some withdrawal fees or minimum deposit requirements. But the trade-off is reliability and speed, since you rely on a centralized or semi-centralized exchange approach that might handle everything in near-real time. You also have the exchange’s support team if an issue arises, which can be quite reassuring.

In short, if you want an all-in-one spot for cross-chain swaps and don’t mind minimal fees, baltex.io is worth considering as an alternative.

Do I really pay zero fees? You typically pay little to no bridging fees to the dApp. However, standard network gas fees apply. So while you might see a “$0 bridging fee,” your transaction may cost a few dollars in gas if it’s on Ethereum, or potentially just pennies on a lower-cost chain.

Why do some free bridges need liquidity providers? Many bridging dApps pool funds (like stablecoins) across different chains. Liquidity providers add their tokens to earn yields or share in protocol revenue. If liquidity is low, your transfer might get delayed or partially filled.

Is bridging safer on paid platforms? Not automatically, but many paid bridges are run by large, established teams, resulting in stronger security audits and higher liquidity. Free bridges can still be safe if they’re reputable and well-audited. Always research the project’s track record.

What if my tokens don’t show up on the destination chain? This can happen if the bridging transaction is stuck, or you need to add the token contract address manually in your wallet. Check the block explorer transaction to confirm it finalized. If everything looks correct on-chain, double-check your wallet’s configuration.

Can I move NFTs with free bridges? Some specialized free bridges support NFTs, but it’s not always possible. NFT transfers typically require a specialized bridging contract. Confirm with the bridging platform or check community forums to ensure NFT bridging is supported.

Where can I find bridging analytics? Sites like Dune Analytics host community dashboards for bridging volumes, transaction counts, and protocol usage. You can filter for specific chains or bridging protocols to see real-time data.

Free crypto bridges are a handy way to sidestep typical bridging fees and explore multi-chain DeFi with more freedom. You’ll still face base chain gas costs, but not the markups that paid bridges levy. By checking audits, liquidity, and community feedback, you’ll reduce your risk of stumbling into a scam or poorly maintained dApp.

Different free bridging solutions support various blockchains. If you’re mainly bridging between Ethereum and BNB Chain, for instance, you’ll find multiple free or nearly free options. For emerging networks like Arbitrum or Avalanche, make sure to confirm that the bridge you’re considering has enough liquidity to handle your transaction.

Compared to paid bridges, free ones might be slower or more reliant on subsidies. That can be a fair trade if your top priority is cost reduction. If you want an all-in-one approach, an exchange like baltex.io can handle cross-chain swaps on your behalf. Keep in mind that every bridging or swapping solution comes with its own set of fees, user experiences, and security profiles.

Finally, always test with small amounts before sending large sums. Crypto bridging is a powerful tool for maximizing returns across multiple chains, but a mindful approach will spare you from unpleasant surprises. With the right research and caution, free crypto bridges can save you a surprising amount on cross-chain transfers, letting you channel your DeFi enthusiasm into actual results instead of high fees.